r&d tax credit calculation example uk

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. 73150 pre-claim Corporation Tax 48450 post-relief Corporation Tax 24700 saving or refund Calculating RD tax credit for loss-making SMEs.

How To Calculate R D Tax Credits With Examples Kene Partners

Work out the costs that were directly attributable to RD.

. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. The corporation tax saving.

Give us a call to talk to one of our specialists. Profitable SME - RD tax savings equate to approx 25 of the eligible spend. It was increased to.

If there is a 100000 payment to a subcontractor of which half is for RD activities the calculation would be 100000 x 50 50000 x 65 32500. Calculator for RD tax credit Our R and D tax credits calculator RD tax credits. 1974100 - 390000 1584100.

The RD Tax Relief for UK small and medium-sized enterprises SMEs has the same calculation for all companies applying to the program but your companies corporation tax has an effect on. Multiply the fixed-base percentage by the average annual gross receipts from the previous four years to determine the base amount. RD Tax Credit Calculation Examples As an example if youre a profit-making SME spending 50000 on research and development you could stand to recover up to 12500.

Select either an SME or Large. To calculate your expenditure you need to. 100k qe in this example.

For example if your RD expenditure was 100000 you may be eligible for an 11000 tax credit or reduction. 1900000 - 1584100 315900 approximately 19 Large companies that either made a. RD tax credit calculation examples MPA from mpacouk.

Reduce any relevant subcontractor or external staff provider payments to. Just follow the simple steps below. If the company spent 100000 on RD.

95000 19 of 500000 taxable profit minus rd relief. So on say 100000 of eligible. According to the latest available figures UK companies claimed a total of 74.

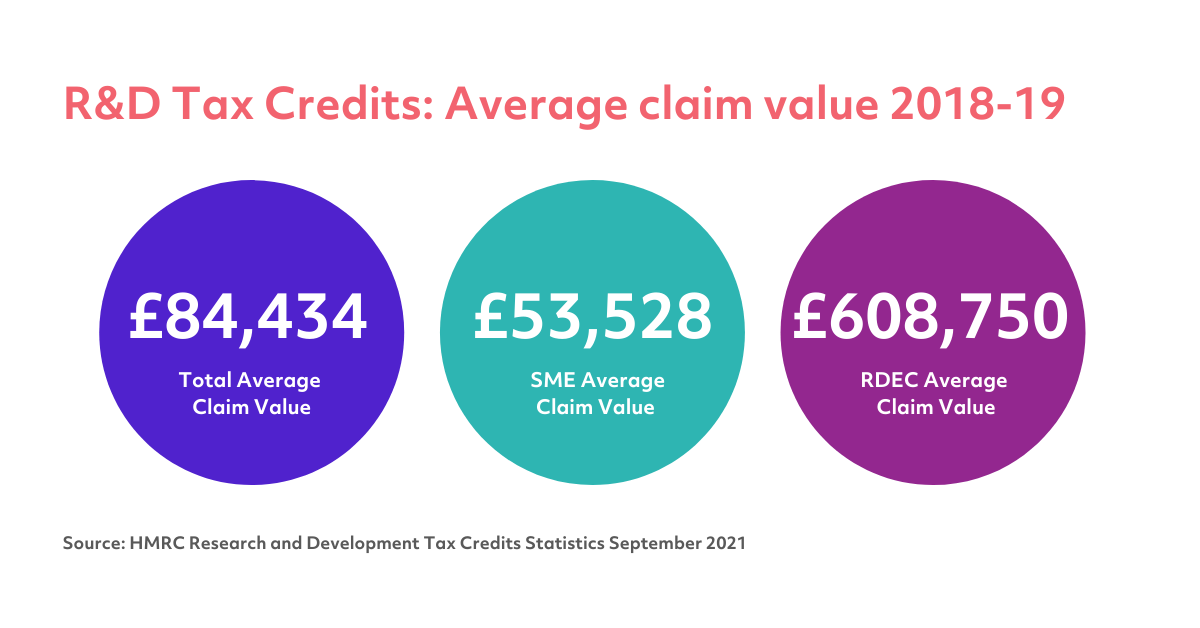

RD tax credit calculation examples MPA from mpacouk. The average value of a claim in the SME and RDEC schemes is 53876 and 272881 respectively. If in 2022 a to z construction had qualified research expenses of 70000 they.

Take the greater of the base amount calculated or 50 of. Loss making SME - RD tax savings equate to approx 33 of the eligible spend. This can be done for the current financial year and the 2 previous.

The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

Three Reasons To Stop Ignoring R D Tax Credits Mpa

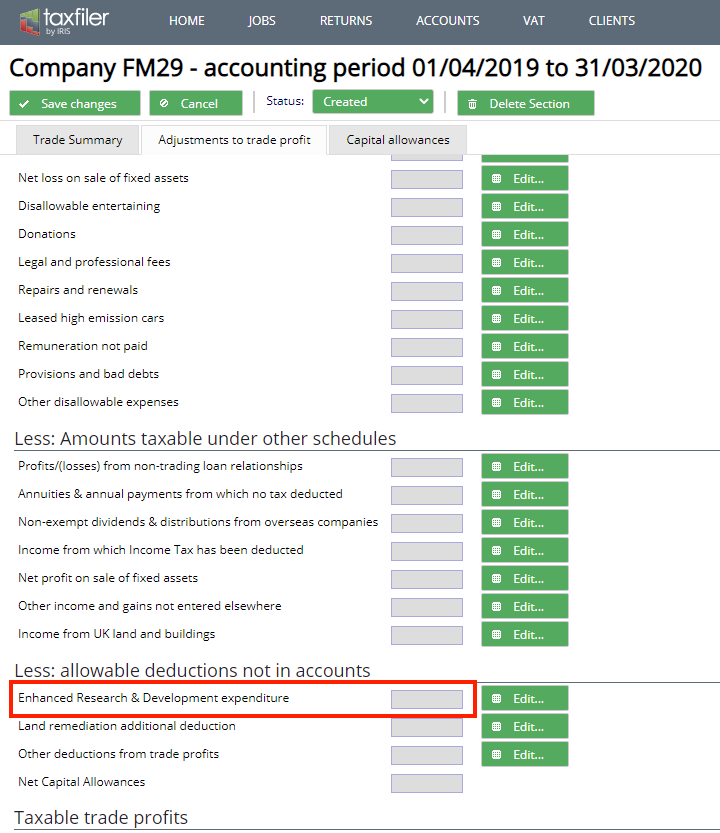

Research And Development Or Film Relief And Tax Credits Support Taxfiler

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

The Ultimate R D Tax Credits Guide Explained 2021

R D Tax Reliefs Not Just Lab Coats And Microscopes Ppt Video Online Download

A Complete Guide To The New Ev Tax Credit Techcrunch

Claiming R D Tax Credits For Your Manufacturing Business

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

The Top 5 Myths About R D Tax Credits For Small Businesses Ardius

Research Development R D Tax Credits Faqs Bdo

R D Tax Credits Calculation Examples G2 Innovation

What Is The R D Tax Credit And Could Your Company Qualify

Research Development R D Tax Credits Faqs Bdo

R D Tax Credits A Guide To Eligibility Claim Preparation And Calculation

Rdec 7 Steps R D Tax Solutions

Is It Too Late To Claim The R D Tax Credit In 2021 Leyton Blog

R D Tax Reliefs Not Just Lab Coats And Microscopes Ppt Video Online Download